kansas sales and use tax exemption form

Give your assigned exemption number where indicated. How to use sales tax exemption certificates in Kansas.

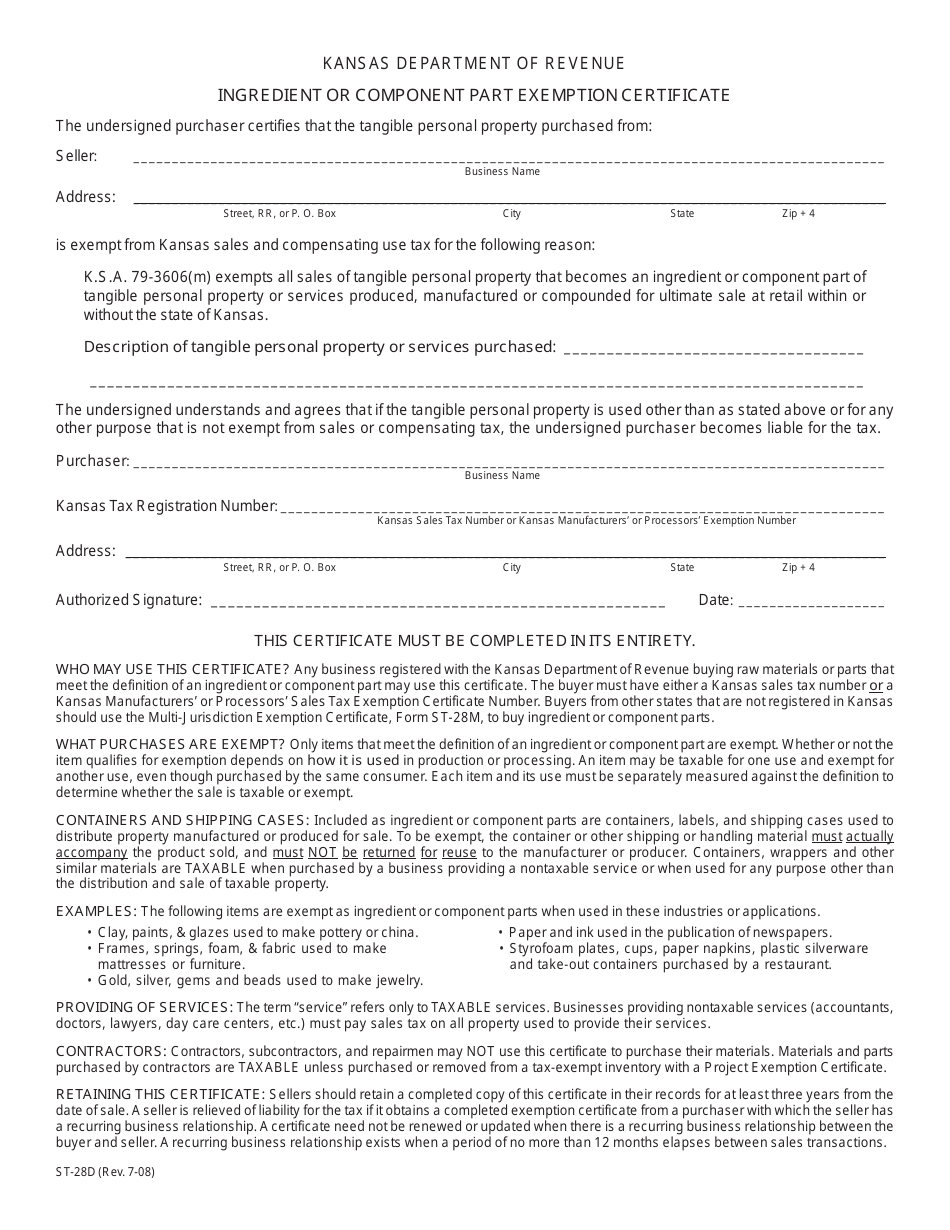

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

The company can claim either the 15 percent credit or up to the 1125 percent whichever is less.

. The format of this sample can be used to create legally valid exemption certificates to be filed with a seller at the time of a purchase. Streamlined Sales and Use Tax Agreement Certificate of Exemption Kansas This is a multi-state form. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Tax Exemption TX TX Application Form 47k TX Addition 79-201 Ninth 19k Humanitarian Service Provider TX Addition 79-201 Seventh 13K Parsonage TX. Your Kansas Tax Registration Number 000-0000000000-00.

For non-profits that have received a sales tax exemption certificate from the Kansas Department of Revenue the exemption certificate is good only from its effective date and can have an expiration date. This form is to be completed and submitted to the Division of Financial Services by the 5th. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax AgreementPlease note that Kansas may have specific restrictions on how exactly this form can be used.

Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 1. Burghart is a graduate of the University of Kansas.

Keep these notices with this booklet for future reference. Ov for additional information. Is exempt from Kansas sales and compensating use tax for the following reason.

Fast Processing for New Resale Certificate Applications. Other Kansas Sales Tax Certificates. This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a tax-exempt entity like a government agency or tax-exempt nonprofitThe contractor must certify that the goods being purchased tax-free are exclusively for use on the tax-exempt entitys contract.

As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. If you want to. Sales and use tax.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. 79-3606k WHEN ALL THREE 3 OF THE FOLLOWING ARE MET. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. The certificates will need to be renewed on the departments website. You may use the State of Kansas exemption certificate exclusively-that is an agency decision.

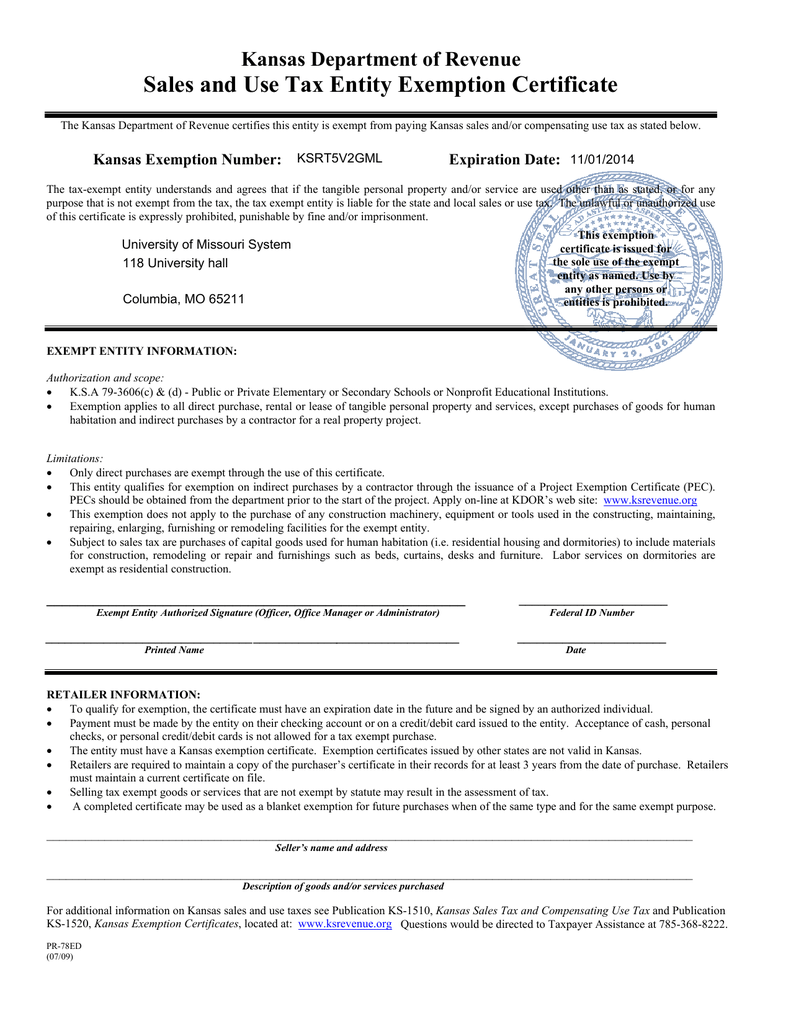

For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. Ad Fast Online New Business Sale Use Tax Exemption Certificate. On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire.

Kansas Application for Sales Tax Exemption Certificates KS-1528 Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates. ST-28F Agricultural Exemption Certificate Rev 12-21 Author. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide. Save Time Signing Documents from Any Device.

To apply for update and print a sales and use tax exemption certificate. Streamlined Sales and Use Tax AgreementCertificate of Exemption Kansas This is a multi-state form. SalesTaxHandbook has an additional three.

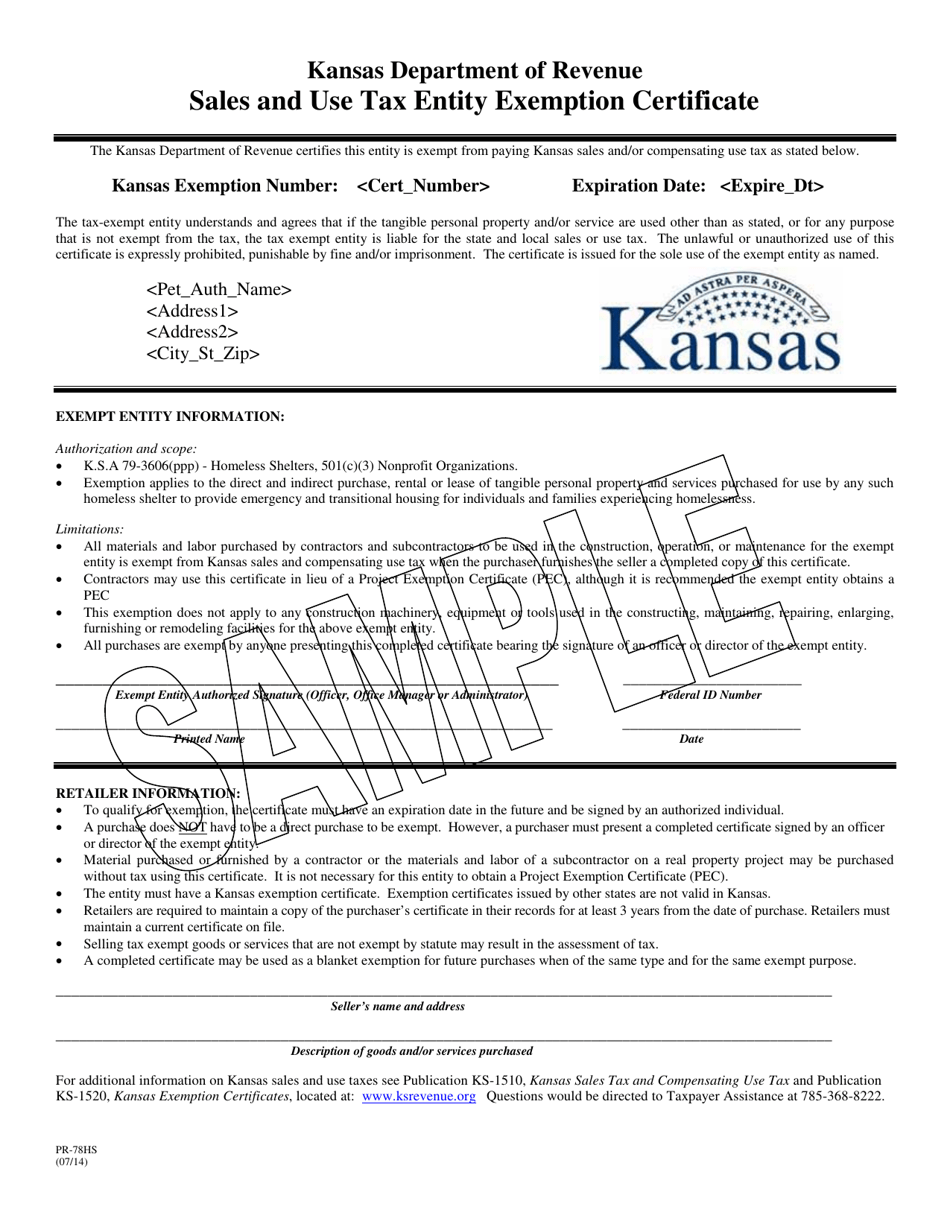

T00112020 The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any. Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. It is designed for informational purposes only.

The renewal process will be available after June 16th. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

The following entities and organizations are exempt and issued a Tax Exempt Entity Certificate from the Kansas Department of Revenue. Ov for additional information. Not all states allow all exemptions listed on this form.

For a Kansas sales tax exemption certificate to be provided to vendors for University purchases or for information regarding the Universitys sales tax exemption status in other states please contact KSU General Accounting office at 785 532-6202. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums dependent on the companys affiliation.

Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 2. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. Kansas Sales Use Tax for the Agricultural Industry at.

The seller may be required to provide this. You may also obtain the. Organization that is subject to federal income tax and reported on a federal Form 990-T is subject to Kansas income tax.

Sale Use Tax Exemption Certificate.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form Pr 78hs Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Homeless Shelters Sample Kansas Templateroller

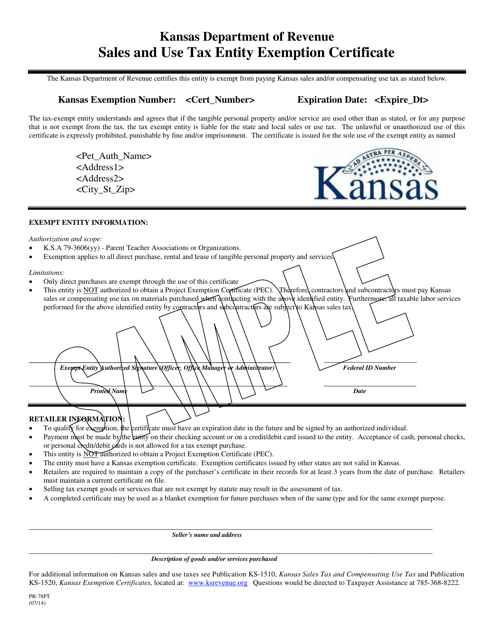

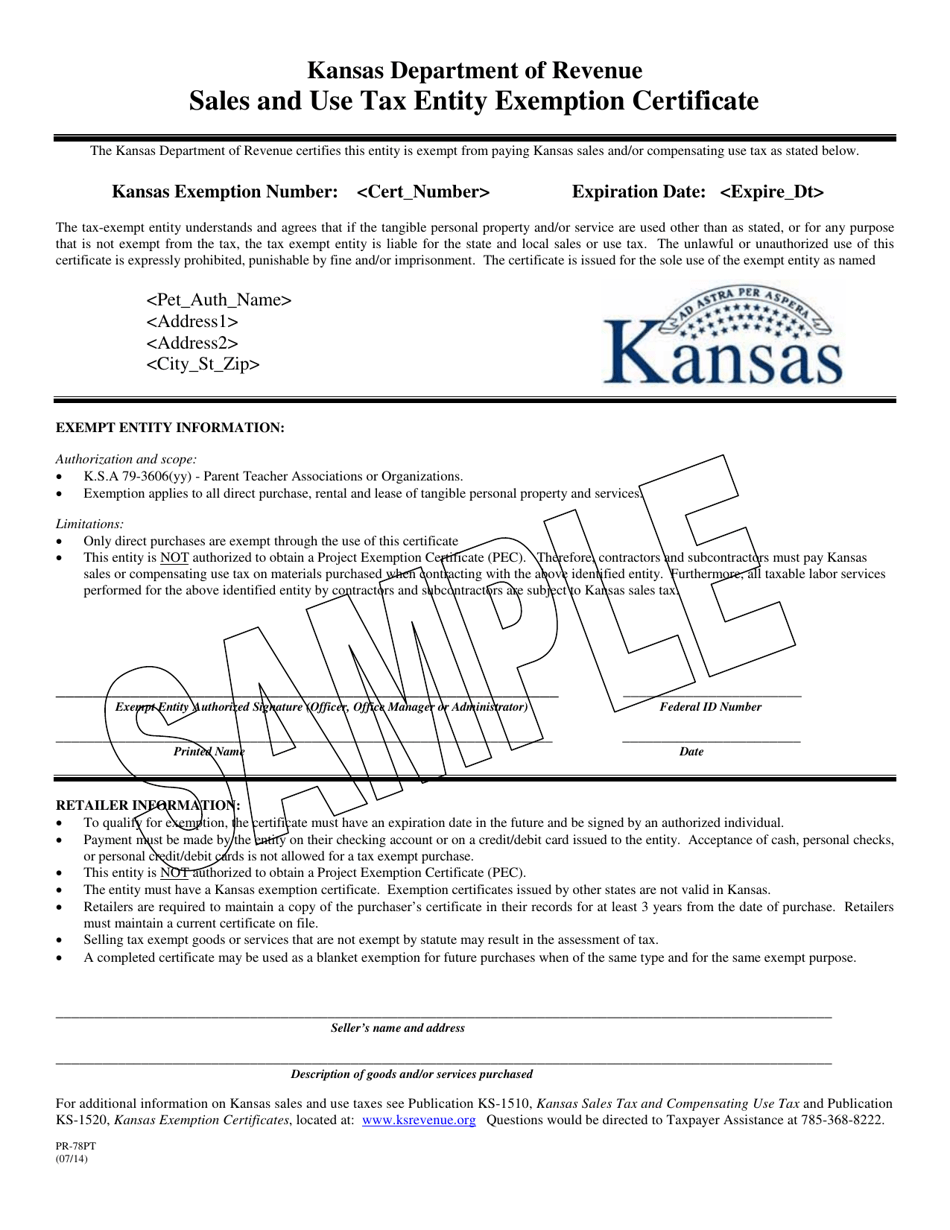

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue